About Us

Strategic partnerships with financial institutions, corporations, specialist firms to provide comprehensive solutions for wealth planning.

OUR VISION

Partner with our clients to build, safeguard and preserve their wealth for the present generation and leave a legacy for future generations.

OUR MISSION

Listen to understand the needs of families and high net worth individuals.

Provide financial counselling.

Strategize with our clients their objective investment and succession planning.

Implement agreed strategies with trust and integrity

OUR VALUES

Transparency – being open and having honest communication with our clients

Trustworthy – acting with integrity, building strong relationships, and inspiring confidence with our clients

Stewardship – responsible and ethical management of our clients’ wealth with duty of care, accountability and timely reporting

WHO WE ARE

![]()

EFFECTIVE STRATEGY

We help our clients clarify and articulate their needs. We help them address their priorities and executive effective strategies to preserve their family’s wealth and legacy.

![]()

MULTIDISCIPLINE TEAMS

Our multidiscipline teams work with families to achieve their objectives, implement their wealth strategies locally and overseas, and establish long-term structures fit for the future.

![]()

ACHIEVING INVESTMENT

We help our clients achieve their investment objectives and plans for their personal assets and business assets.

Investment Philosophy

Three Prong KPI

As we witness a global shift in economic transformation towards humans and economies, we are also seeing a shift towards sustainability in the investment landscape.

Our purpose is to contribute positively to this transformation that forms the cornerstone of our investment philosophy. This philosophy is supported by model portfolios that have a proven track record to outperform the market.

- Disciplined & analytical methods

- Act to capitalize on markets’ intermittent inefficient pricing

- Grow returns in the long-term.

- Optimise financial returns

- Good governance

- Positive impact on community & environment.

- Focus on net positive returns

- Minimize negative impacts from negative cyclical swings

LEVERAGING NETWORKS

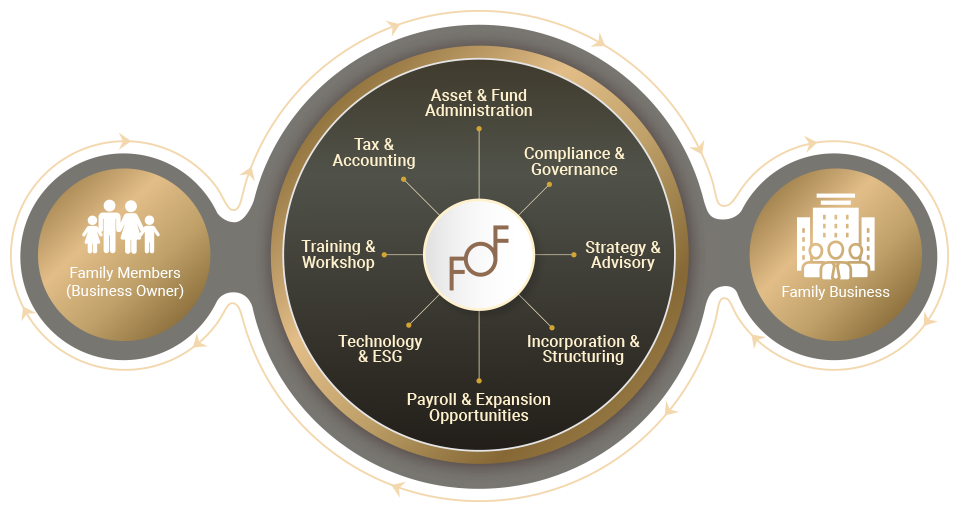

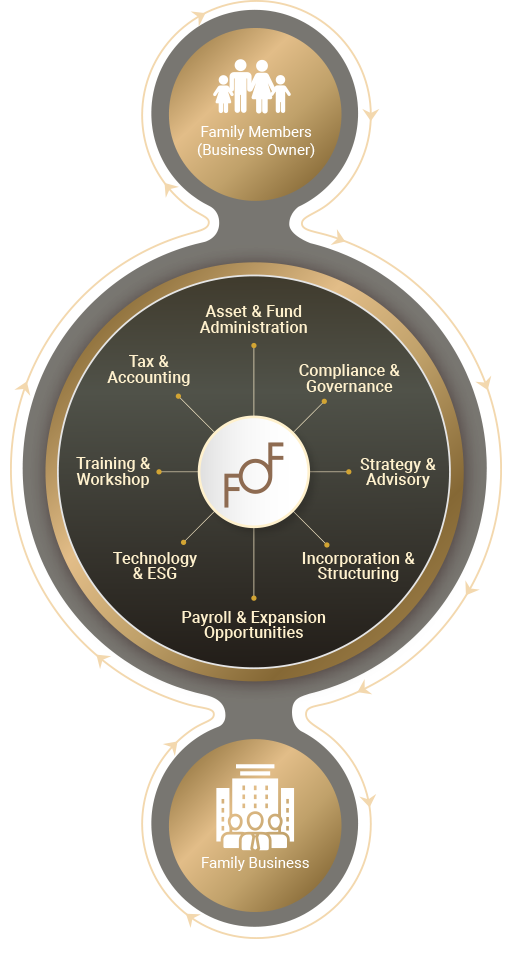

We work in strategic partnerships with financial institutions, corporations, specialist firms to provide comprehensive solutions for wealth planning. Our teams work collaboratively with our partners, pool our resources, and create opportunities to provide expert and comprehensive solutions meet our clients’ short-medium-long term objectives. We offer a suite of services through our networks and they include:

Our Edge

INVEST IN RELATIONSHIPS

We are a multi-family office dedicated to the success of business families across generations. Our approach is built on a foundation of understanding and addressing our clients’ needs. We achieve this by investing in experienced professionals who believe in cultivating enduring relationships that truly benefit our client families. Acting as their trusted stewards, we operate transparently, ensuring our advice is always aligned with their best interests, informed by attentive listening.

We pride ourselves as a multi-family office that:

- Works with care and transparency

- Embodies true partnership and understanding

- Remains grounded in professionalism and expertise

- Empowers families to create a positive impact

FAMILY GOVERNANCE FOR HARMONY & WEALTH STABILITY

We dedicate time and effort to work closely in collaboration with families through regular meetings to establish a solid base and encourage harmonious connections among family members, paving the way for the family intergenerational success as a family enterprise.

We help clients to define their investment strategies and business operations clearly. Rather than leaving investment and business decisions to chance, clients often want to establish specific rules that prevent any single family member from unilaterally changing the strategies. These guidelines ensure alignment among participating family members and protect both wealth and harmony of the family enterprise.

FAMILY GOVERNANCE FOR HARMONY & WEALTH STABILITY

Family enterprise value occur due to

- Disagreements in definition of family members and classes of members

- Differing interest and opinion on distribution criteria among classes

- Gaps in interpreting enterprise vision & core values

- Intra family relationship conflicts

- Disagreement in structural settings – succession of roles & talent mismatch

- Data integrity and source conflicts

INVEST IN RELATIONSHIPS

We are a multi-family office dedicated to the success of business families across generations. Our approach is built on a foundation of understanding and addressing our clients’ needs. We achieve this by investing in experienced professionals who believe in cultivating enduring relationships that truly benefit our client families. Acting as their trusted stewards, we operate transparently, ensuring our advice is always aligned with their best interests, informed by attentive listening.

We pride ourselves as a multi-family office that:

- Works with care and transparency

- Embodies true partnership and understanding

- Remains grounded in professionalism and expertise

- Empowers families to create a positive impact

FAMILY GOVERNANCE FOR HARMONY & WEALTH STABILITY

We dedicate time and effort to work closely in collaboration with families through regular meetings to establish a solid base and encourage harmonious connections among family members, paving the way for the family intergenerational success as a family enterprise.

We help clients to define their investment strategies and business operations clearly. Rather than leaving investment and business decisions to chance, clients often want to establish specific rules that prevent any single family member from unilaterally changing the strategies. These guidelines ensure alignment among participating family members and protect both wealth and harmony of the family enterprise.

FAMILY GOVERNANCE FOR HARMONY & WEALTH STABILITY

Family enterprise value occur due to

- Disagreements in definition of family members and classes of members

- Differing interest and opinion on distribution criteria among classes

- Gaps in interpreting enterprise vision & core values

- Intra family relationship conflicts

- Disagreement in structural settings – succession of roles & talent mismatch

- Data integrity and source conflicts